|

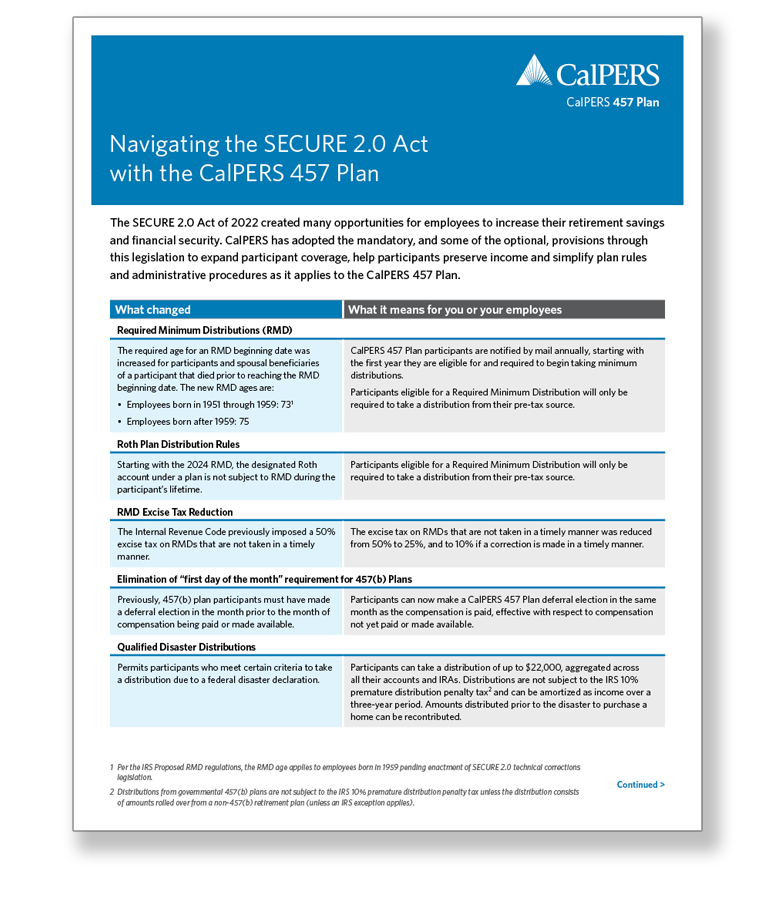

Navigate the SECURE 2.0 Act with CalPERS 457 Plan

As the new year begins, please remember that more provisions go into effect as a result of the SECURE 2.0 Act of 2022. The Navigating the SECURE 2.0 Act guide can help you keep track of what’s changed, what it means for you and your employees, and what optional provisions CalPERS has elected to adopt for the CalPERS 457 Plan. The document will be updated as needed, so make sure to bookmark it for reference throughout 2026. |

|

| If your agency pays into FICA (Social Security tax) for a participating employee, look for information throughout the year as you make a reasonable good faith effort throughout 2026 to comply with the new age-based catch-up contribution requirement for FICA-eligible employees who are age 50 or older by the end of 2026 and made $150,000 or more in 2025. For payroll and myCalPERS support, call the CalPERS 457 Employer Plan Line at 800-696-3907. |

Notify CalPERS when an employee has a change

in status due to military duty or a leave of absence

It’s vital to let CalPERS know when a CalPERS 457 Plan participant has been called to military duty or has been approved for a leave of absence, especially if they have an outstanding loan. Loan repayments will need to be suspended and extended for the time an employee is on active military duty or re-amortized to a new loan repayment amount based on the length of the leave of absence.

| If you have any questions about reporting employee changes or changes to your agency’s personnel responsible for administering the CalPERS 457 Plan, email us or call 800-696-3907 weekdays between 8 a.m. – 5 p.m. PT. |

It is vital to let the CalPERS 457 Plan team know when there are changes to your personnel. Let’s work together to ensure that we have updated records of your agency’s points of contact, their roles, and how to reach them by phone and email. Please report any changes to the CalPERS 457 Plan team as soon as possible by contacting:

|

Navigate the SECURE 2.0 Act with the CalPERS 457 Plan Notify CalPERS when an employee has a change in status due to military duty or a leave of absence Resources to help process enrollments for employees joining the CalPERS 457 Plan Watch for your agency’s 2025 CalPERS 457 Plan Year-end Summary Make a plan to provide your employees with education in 2026 When’s the last time you had a CalPERS 457 Plan review?

|

CalPERS Employer Resource Center making cents Participant Newsletter Schedule a Personal Phone Appointment

|